tax ny gov enhanced star

If you are a new homeowner or first-time STAR applicant you may be eligible for the STAR credit. New York State revised the filing and approval procedure for all Enhanced STAR applications beginning in the 201920 tax year December 2019 to November 2020 tax bill.

Deadline For Seniors Enhanced Star Exemption In Suffolk Towns Is March 1 Newsday

There are two types of STAR exemptions.

. You can receive the STAR credit if you own your home and its your primary residence and the combined income of the owners and the owners spouses is 500000 or less. New changes to star program. Www tax ny gov enhanced star.

The Enhanced STAR exemption provides an increased benefit for the primary residence of a senior citizen age 65 and older who has a qualifying 2020 income of less than 92000. The Basic STAR exemption is available to all eligible homeowners with incomes below 250000 regardless. New York State recently altered the STAR program lowering the maximum income limit for the Basic STAR tax exemption to 250000.

Register with the NYS Department Taxation Finance at 518-457-2036 or wwwtaxnygovstar. If you answered No to either question 2 or 3 then you do not qualify for the Enhanced STAR exemption but may continue to receive Basic STAR. The benefit is estimated to be a 650 tax reduction.

You can register for the state tax credit at wwwtaxnygovstar or by calling 518 457-2036. RP-425-MBE 122 wwwtaxnygov Property key. 4 Do you or your spouse own another property that is either receiving a STAR exemption in New York State or a residency-based tax benefit in another state such as the Florida Homestead.

The benefit is estimated to be a 293 tax reduction. Enhanced STAR is available to senior citizens age 65 and older who own and live in their primary residence and who meet certain income requirements see below. Apply and are eligible for the Enhanced STAR exemption.

With Basic STAR exemptions who wish to apply and are eligible for the Enhanced STAR exemption. You may be eligible for an Enhanced STAR exemption The STAR program provides eligible homeowners with relief on their school property taxes. The state Tax Department said 577000 seniors saved more than 800 million from the Enhanced STAR exemption last year.

As long as you. Please do not contact our office regarding this program as it is filed directly with new york state. As a result of recent law changes the star program is being restructured.

Ad Download Or Email NY RP-425 More Fillable Forms Register and Subscribe Now. PLEASE BE SURE THAT YOU FILE BOTHTHE RP-425E. This requirement applies to property owners who received Basic STAR benefits and are applying for Enhanced STAR and those already receiving Enhanced STAR benefits but who did not register for the Income Verification Program IVP.

If youve been receiving the STAR exemption since 2015 you can continue to receive it for the same primary residence. That represents savings of nearly 1400 per homeowner. The New York State Department of Taxation and Finance will annually determine income eligibility for qualifying Enhanced STAR applicants.

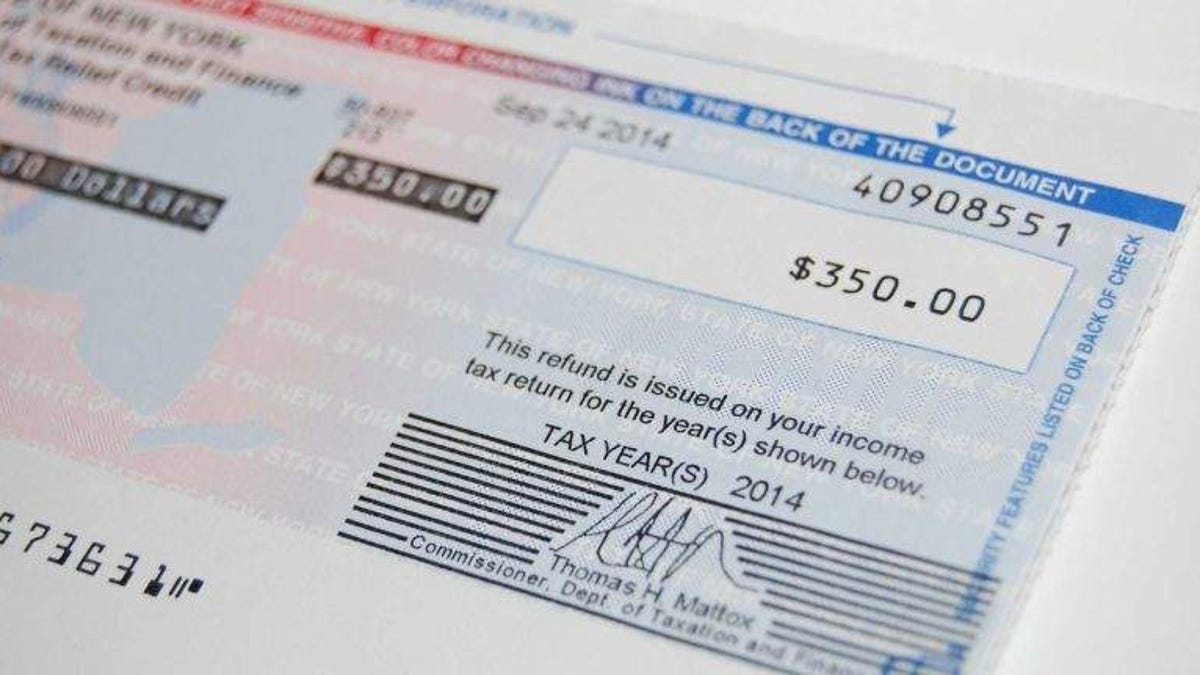

If youre eligible for the STAR credit youll receive a check for the amount of your STAR savings. The enhanced STAR exemption is available for owner occupied primary residences of senior citizens who are turning 65 during the next calendar year with household incomes not exceeding the statewide standard 86300 for 2017. Seniors who receive the STAR credit instead of the STAR exemption dont need to apply or take any other action.

If you are a new homeowner or first-time STAR applicant you may be eligible for the STAR credit. In the past senior citizens who qualified for the senior citizens exemption were automatically granted the enhanced star exemption. For a list of who else should use this form see the instructions on page 2.

If you are using a screen reading program select listen to have the number announced. Seniors with questions about the STAR exemption can contact the Tax Departments STAR Hotline from 830 am. However you may be eligible for the enhanced star credit.

The following security code is necessary to prevent unauthorized use of this web site. Beginning with the October 20192020 school tax bill the state will automatically switch current Basic STAR tax exemption participants with a household income greater than 250000 and less than or equal to 500000. A reduction on your school tax bill.

NEW STAR applicants must register with NYS Tax Department at 518 457-2036 or visit them at wwwtaxnygovstar Enhanced STARSenior Aged A copy of your latest Federal or State Income Tax Return deed and drivers license must be submitted along with a complete and signed. Enter the security code displayed below and then select Continue. New star recipients will receive a check directly from new york state instead of receiving a school property tax exemption.

The Basic New York State School Tax Relief STAR and the Enhanced School Tax Relief ESTAR exemptions reduces the school tax liability for qualifying homeowners by exempting a portion of the value of their home from the school tax. The STAR Program provides school district property tax relief to all residential property owners and enhanced property tax relief to income eligible senior citizens age 65 or older. Enhanced STAR is for homeowners 65 and older whose total household income for all owners and spouses who live with them is 92000 or less.

If you did not own this property and receive STAR in tax year 2015-16 you cannot apply for E-STAR with the Department of Finance. This will exempt the first 66800 of. The Tax Department will automatically upgrade them to Enhanced STAR if they qualify.

The amount of the benefit will be the same. Enhanced STAR is a school property tax benefit that saves most senior homeowners in New York State hundreds of dollars each year. The Enhances STAR Exemption will provide an average school property tax reduction of at least 45 annually for seniors living in median-priced homes.

New York State has changed the STAR application process. Your total combined income cannot exceed 92000. Register with the NYS Tax Department at wwwtaxnygovstar.

Owner-occupied property that is a one two or three-family residence a mobile home or trailer a farm home or a residential condominium or cooperative apartment and which serves as the primary residence of the owner or that portion of any other type of property which is partially used by the owner as a primary residence is partially exempt from school district. To qualify for the Basic STAR exemption the home must be the owner-occupied primary residence where the combined income of the owners and. Who is eligible for Enhanced STAR.

What Is The Enhanced Star Property Tax Exemption In Nyc Hauseit

Tax Collector Tax Assessor Town Of Lewis Ny

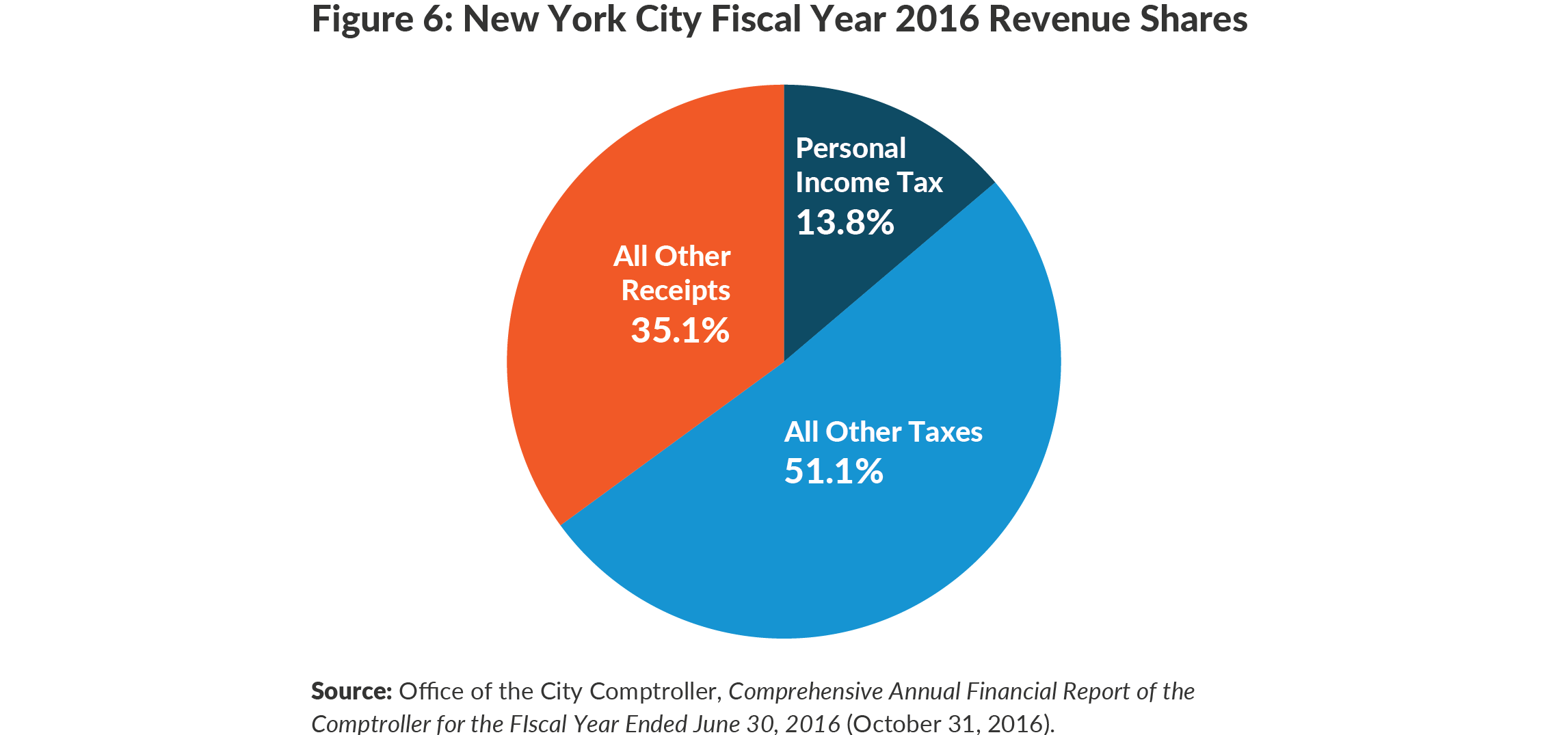

Personal Income Tax Revenues In New York State And City Cbcny

Governor Cuomo Signs Fy 2022 Budget And Announces Continuation Of Middle Class Tax Cuts To Help New Yorkers Recover From Economic Hardship During The Covid 19 Pandemic Governor Kathy Hochul

The School Tax Relief Star Program Faq Ny State Senate

Enhanced Star Income Verification Program Ivp Enhancement Stars Income

Rebate Checks Gone In Nys Star Checks Continue For Now Yonkers Times

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

Personal Income Tax Revenues In New York State And City Cbcny